2025 Market Forecasters’ Report Card

Key Takeaways

Analyst forecasts for 2025 highlight the challenge of predicting market outcomes.

Consensus 2025 estimates were closer to reality than in previous years.

Investors reacting to revised forecasts may have missed strong market rebounds.

New estimates from major banks and other research firms have begun to emerge, forecasting the price of the S&P 500® Index at the end of 2026. It’s something investors can count on seeing around this time every year and can have an influence on their own feelings about the market and their investments.

So, this article is aimed at providing context that we believe can help investors keep focus on what matters through this season of annual analyst forecasts.

How Analyst Predictions Help Shape Investor Sentiment

Investors should understand that every forecast is based on an analyst’s interpretation of the available data at the time it was made. Analysts often have different interpretations of the same information, which can lead to a wide range of predictions.

But, further, if you forecast where the market will be in a year then you also can be sure to face a lot of new and unexpected news before the forecasted date arrives. News that no one knew was coming will affect markets, economies, currencies, and so on. You can probably think of a few events that this time last year you had no idea would have impacted markets this year.

This means forecasts of future market prices not only face uncertainty rooted in an individual or firm’s interpretations of current information but also the unknown events and news that are yet to happen.

You might be thinking: what does this all mean for the success rate of these annual S&P 500 price target predictions?

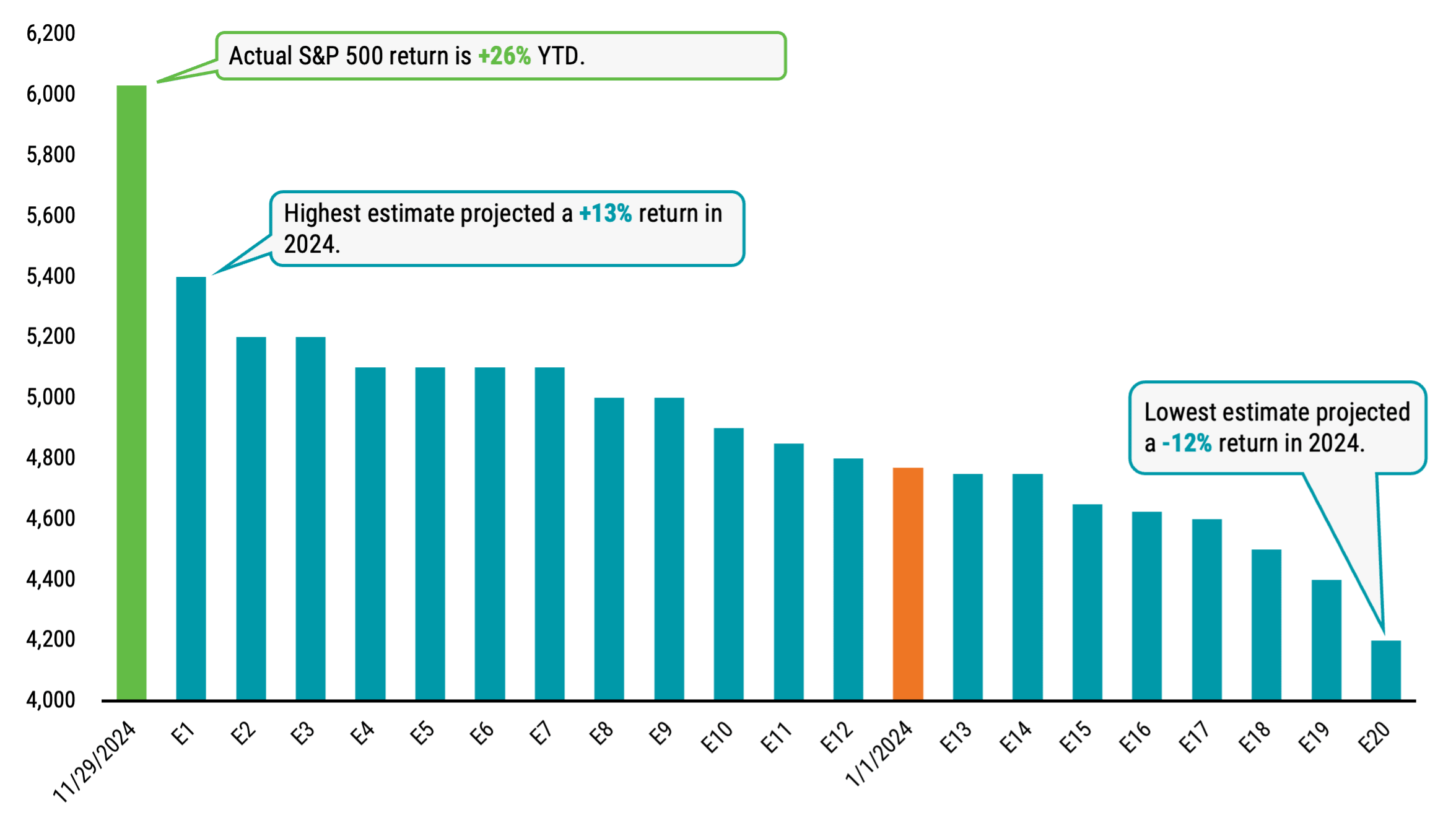

Well, we’ve got some answers, starting with the 2025 year-end price targets issued in late 2024. In Figure 1, we display price estimates from 20 different strategist firms (blue bars) and include the actual index price at the start of 2025 (orange bar) and at the end of November (green bar) for reference.

Figure 1 | 2025 S&P 500 Price Targets from Late 2024 Show a Wide Range of Estimates but Some Not Far from Reality

Data as of 11/28/2025. Derek Saul, “Here’s How Wall Street Expects S&P to Perform in 2025,” Forbes, December 2, 2024; Matthew Fox, “Here’s a Complete Rundown of Wall Street’s Stock Market Predictions,” Business Insider, December 13, 2024. Past performance is no guarantee of future results.

We certainly observe a wide range of estimates, reflecting the variance that can come from different analyst interpretations of the available data. The most bullish estimate was 7,100 (an implied 21% gain from the start of 2025 price of 5,882), and the most bearish estimate was 4,450 (an implied 24% decline from the start of 2025 price). If someone chose between these two forecasts to guide their portfolio decisions, they could expect very different outcomes this year based on which direction they selected.

Aside from two firms that predicted a negative year for the index in 2025, many firm estimates are reasonably within the range of the realized results so far this year.

Based on the implied return of each price target, six of the 20 estimates are within plus-or-minus 3% of the actual year-to-date return, and 14 are within plus-or-minus 5%. The median estimate of 6,600 is about 4% off (12% implied return vs. 16% actual YTD).

That’s one year.

How Have S&P 500 Forecasts Fared Over Time?

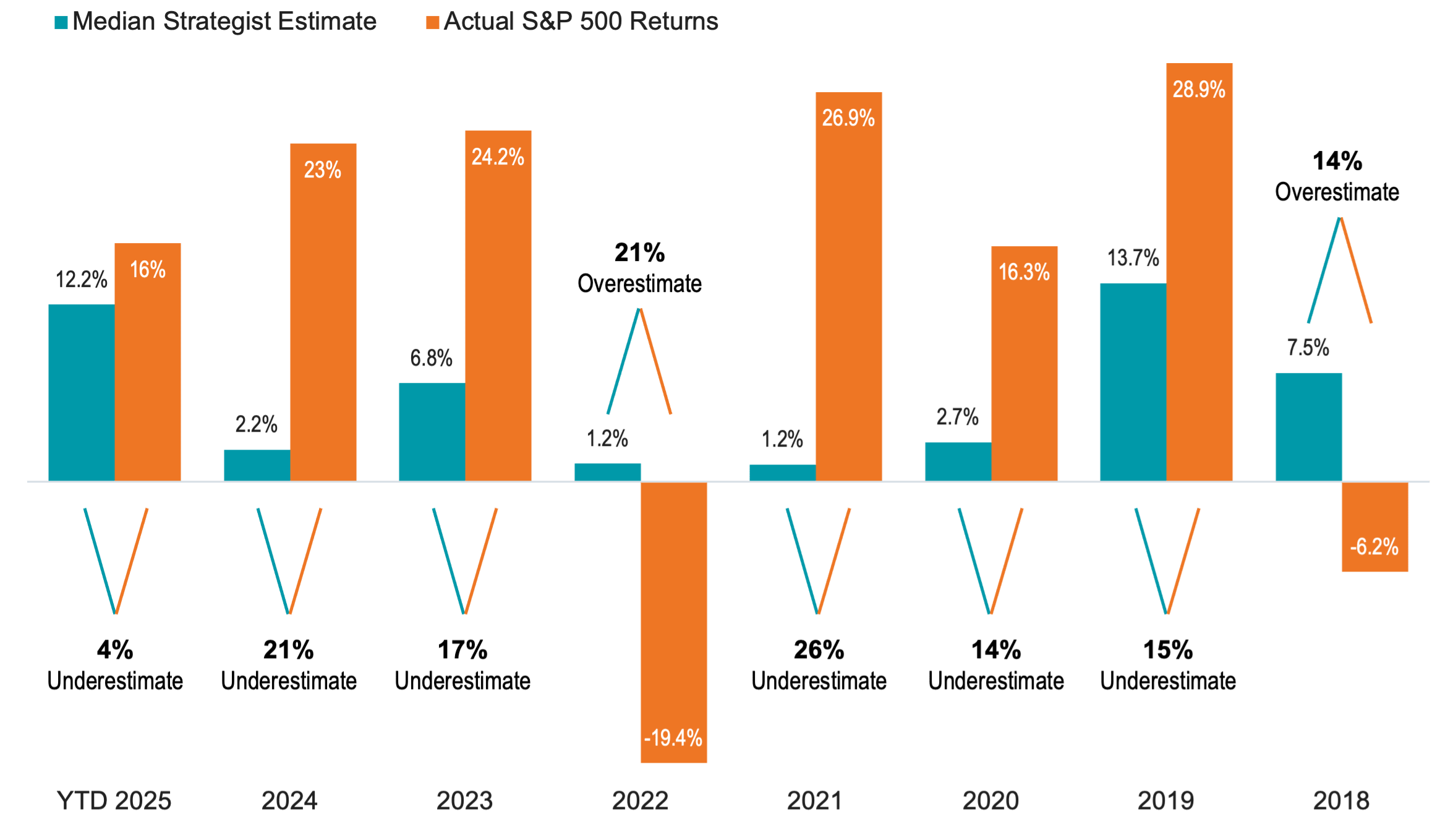

To examine this question, we compared the median estimate’s implied return with the actual S&P return for 2025, as well as the same data from each previous calendar year, dating back to 2018. The results are shown in Figure 2.

Figure 2 | Consensus S&P 500 Estimates vs. Actual Returns (2018-2025)

Data from 1/1/2018 - 11/30/2025. Sources: Emily McCormick, “What Wall Street Strategists Forecast for the S&P 500 in 2019,” Yahoo Finance, December 31, 2018; Jeff Sommer, “Clueless About 2020, Wall Street Forecasters Are at It Again for 2021,” New York Times, December 18, 2020; Jeff Sommer, “Forget Stock Predictions for Next Year. Focus on the Next Decade,” New York Times, December 16, 2022; Senad Karaahmetovic, “Top Wall Street Strategists Give Their S&P 500 Forecasts for 2023,” Investing.com, December 27, 2022; Tom Aspray, “Should You Worry That Strategists Keep Raising Their S&P 500 Targets?” Forbes, October 20, 2024. Derek Saul, “Here’s How Wall Street Expects S&P to Perform in 2025,” Forbes, December 2, 2024; Matthew Fox, “Here’s a Complete Rundown of Wall Street’s Stock Market Predictions,” Business Insider, December 13, 2024. Past performance is no guarantee of future results.

It turns out that median (or consensus) estimates from recent years have not fared well in hindsight. The only year in the sample where the consensus estimate is within plus or minus 10% of the actual index outcome is 2025 year to date. These are the types of outcomes you might expect given the uncertainty and unknowns that come with predicting prices a year out.

It would appear the forecasters have done much better this year. We should give credit where credit is due, right? Well, there’s more to the story.

Many firms that issued these estimates in late 2024 have since revised them multiple times! Notably, in public records, we found that at least 15 of the 20 estimates were updated in April, as market anxiety rose around shifting tariff policies. All were revised downward.

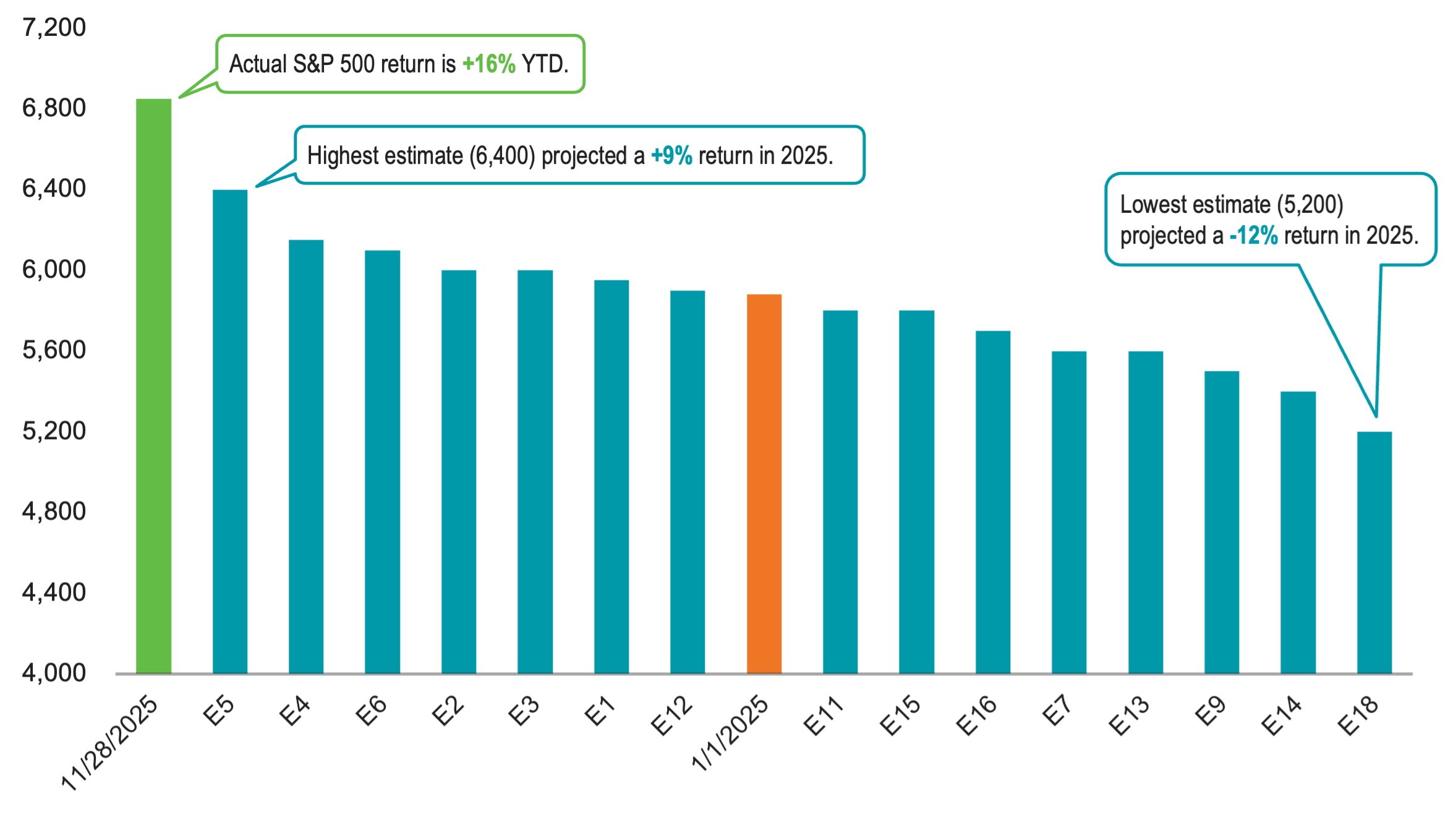

Figure 3 shows the 15 updated estimates from April. (Each new estimate remains linked by label to the same firms shown in Figure 1.)

Figure 3 | Revised S&P Price Targets from April 2025 Were Well Off the Mark

Data from 1/1/2025 - 11/28/2025. S&P 500 price targets were set as of 4/30/2025. Anthony Di Pizio, “Wall Street Analysts Are Slashing Their S&P Targets for 2025. Here’s What You Should Do, Based on Decades of History,” Motley Fool, May 9, 2025.

After the revisions, we still see a wide range of estimates, but now we find that none are near the actual price of the S&P 500 as we approach the end of 2025. More than half implied an expected negative return for the index this year, which is a far cry from the market’s actual 16% gain year to date. As time has passed this year, many firms have revised their estimates upward again.

Now it can be argued that it’s fair to update forecasts as new information becomes available and expectations change. However, we believe this should also cast some doubt on the merit of placing too much weight on these predictions when you see them.

Consider what would happen if you held an investment tracking the S&P 500 Index through April and then withdrew your money after seeing many firms become more pessimistic in their outlooks. Through the first four months of the year, your investment would have lost approximately 5.1%.

If you then decided to reinvest after forecasts were revised higher again in June or July, you could have missed out on the two highest-returning months of the year in May and June. The S&P 500 rose nearly 11.5% over those months. Simply holding throughout the year would have meant enduring a bumpy road, but it would also have ensured you were there for the recovery and the strong gains that followed.

Of course, this is just one example in time, but it illustrates the broader implications for market forecasting. Those who attempt it and take action in their portfolios based on those views may often end up worse off than had they simply remained disciplined.

The good news? If you take a long-term approach to investing, you don't need to predict what will happen in the short term to have a positive experience. It just requires sticking with it through the down days, months, or even years, so that you’re there for the good times.

Remember that security prices are set daily by the consensus of millions of investors who demand a higher return than they can get from risk-free assets. Over longer periods, stocks have a strong historical track record of delivering that premium. This has led to a higher probability of favorable outcomes for disciplined investors. No crystal ball needed.

Explore More Insights

Glossary

A market-capitalization-weighted index of the 500 largest U.S. publicly traded companies. The index is widely regarded as the best gauge of large-cap U.S. equities.

Diversification does not assure a profit nor does it protect against loss of principal.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

The opinions expressed are those of the investment portfolio team and are no guarantee of the future performance of any Avantis Investors portfolio.