Understanding Emotions During Volatile Markets

Anger is a helpful emotion. We are angry when we see a person abused, and that anger compels us to intervene, helping the abused. But anger can be harmful when it compels us to say what we will soon regret, such as insulting a friend.

We cannot learn to eliminate anger, but we can learn to control it through cognitive reflection. We can follow our parents’ advice: “Count till 10 when you are angry before you speak.”

Fear and Hope

Fear is also a useful emotion. Fear causes us to slam on the brakes when the car in front of us suddenly stops. But fear can be harmful when it’s exaggerated. For example, when stock prices slump, fear can magnify perceived risk and compel us to abandon our stock allocation.

Financial advisers can reassure clients by teaching cognitive reflection, reminding them that high stock prices may go down and low stock prices may go up.

Stock market declines induce fear. Days of substantial stock market declines are also days of significant increases in hospital admissions, especially for fear-related conditions like anxiety and panic disorder.1

High stock returns are associated with better mental health, whereas high volatility of returns is associated with poorer mental health.2 Fear induced by earthquakes also increases the probability that people assign to stock market crashes.3

Fear increases risk aversion even among investment professionals, leading to high risk aversion in financial busts and low risk aversion in booms. Investment professionals asked to read a story about a financial bust became more fearful than those asked to read a story about a boom, and fear led them to reduce risky investments.4

Fearful investors often fly to safety, switching from risky investments to safer ones. The VIX Index is a risk gauge also known as the fear index. It measures expectations of future risk by expectations of future volatility of stock returns. Flight-to-safety episodes coincide with increases in the VIX, bearish consumer sentiment and bond returns that have often exceeded stock returns.5

A financial adviser described clients who asked her to sell all their stocks in 2008 and 2009 after the stock market crash, yet reversed themselves in 2014 by asking her to buy stocks after the stock market recovered. "It's an emotional reaction,” she said. “[The years] 2008 and 2009 were like being in the fetal position. Now in 2014, everyone wants to buy.”6

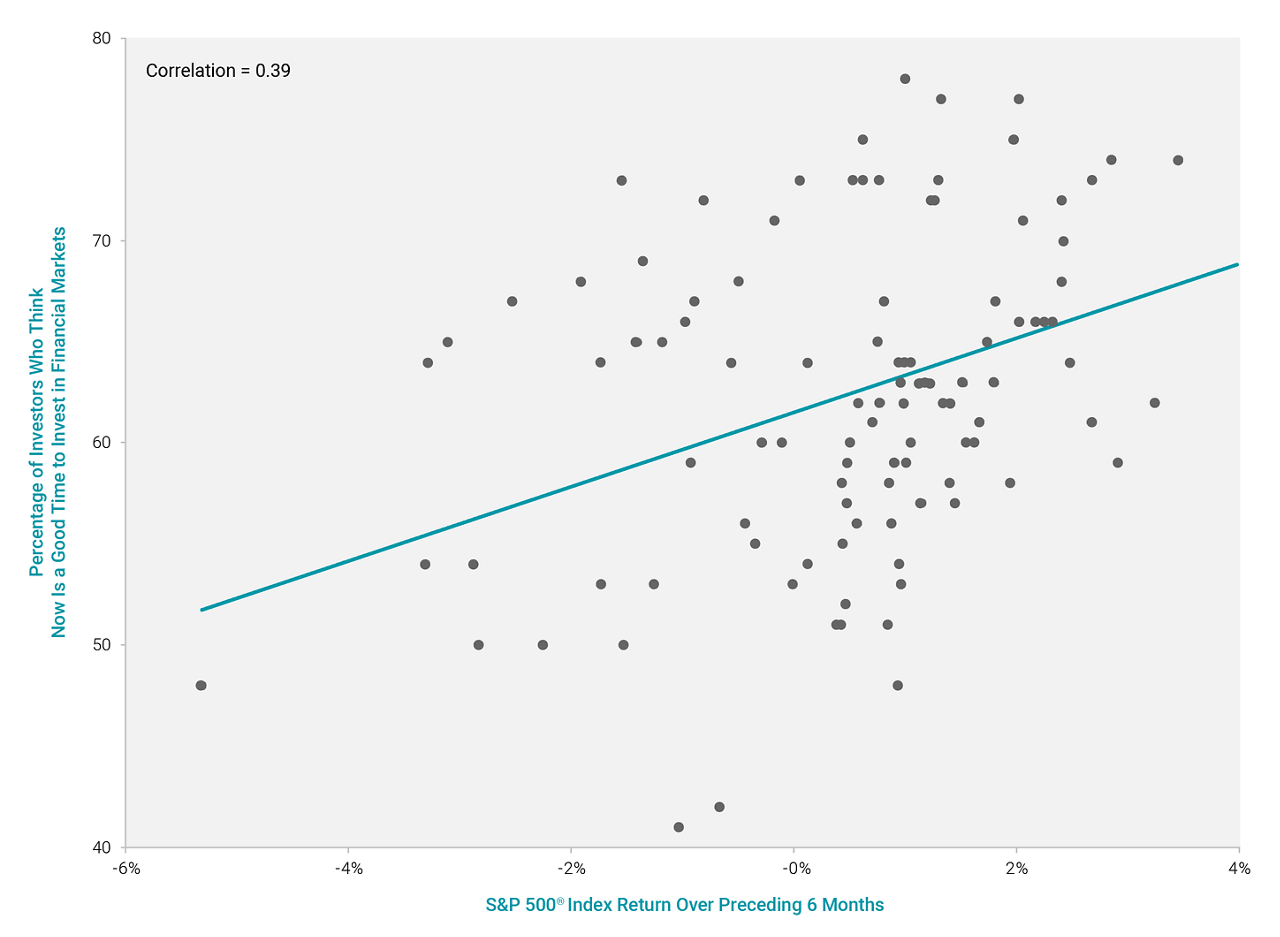

Fearful investors expect low returns with high risk, whereas hopeful investors expect high returns with low risk. Brokerage records and matching monthly surveys show that high past returns are associated with increased return expectations, decreased risk perceptions and risk aversion.7 A Gallup survey of investors asked: "Do you think that now is a good time to invest in the financial markets?"

Figure 1 shows that recent high returns are followed by high percentages of investors who think now is a good time to invest. For example, 78% of investors answered "yes" in the exuberant days of February 2000 after major stock gains. Yet only 41% answered yes in the fearful days of March 2003 after major stock losses. Gallup also asked investors if they believe the market is overvalued or undervalued.

Figure 1 | Investors Think Periods Following High Stock Returns Are Good Times to Invest in Financial Markets

Data from 6/30/1998 - 12/31/2007. Source: Gallup.

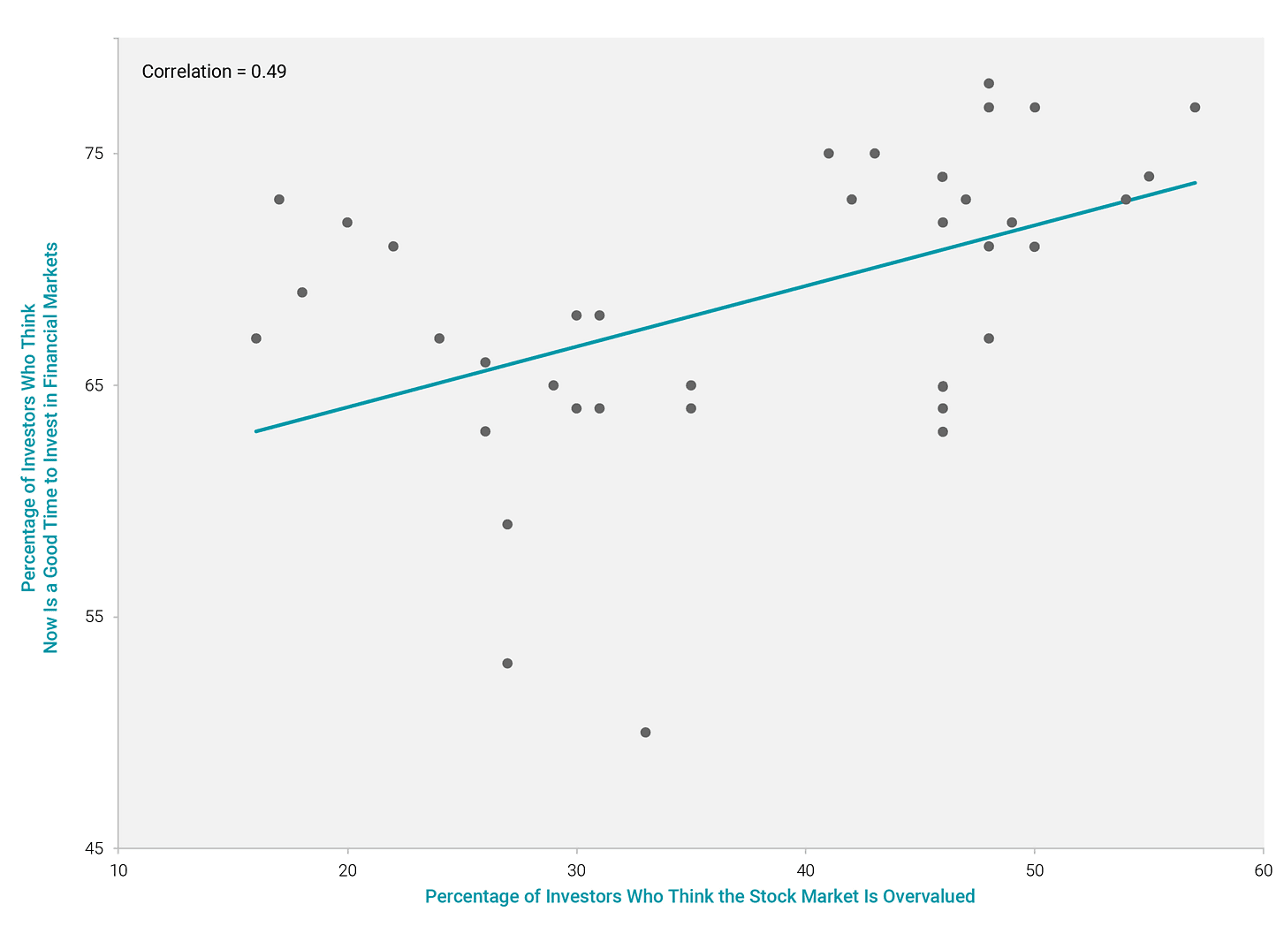

Figure 2 shows that months when large proportions of investors believe the stock market is overvalued are also months when they think now is a good time to invest in the financial markets. These beliefs are consistent with the intuitive system we know as System 1 but inconsistent with the reflective System 2, in which a belief that the stock market is overvalued accompanies a view that now is not a good time to invest.

Figure 2 | Investors Think Periods When the Stock Market Is Overvalued Are Good Times to Invest in Financial Markets

Data from 6/30/1998 - 7/31/2002. Source: Gallup.

How Fear Can Fuel Risk Aversion

Links between fear and risk aversion have been uncovered in many experiments. Consider the cash-out experiment, lasting 25 rounds. You begin with $10 in a stock whose price can go up or down in each round.

After the stock’s current price is displayed, you can choose to play the next round or cash out by selling the stock at its current price. If you cash out at the start of the game, you keep your $10. If you play one or more rounds, you keep the amount of the price of the stock at the end of the last round you play. How many rounds would you play?

Video clips showing scenes from two horror movies, The Sixth Sense and The Ring, induced fear in one group of people playing the cash-out game. People in a control group saw scenes from two benign documentaries about Benjamin Franklin and Vincent Van Gogh. Fear led to an early sell-off of the stock. This emotion is also contagious — fearful people sold especially early when they believed others shared their fear.8

People in another experiment saw a clip from Hostel, another horror movie, showing a man tortured in a dark basement. Increased risk aversion was evident among the people who watched the clip but not among those who reported enjoying horror movies.

The experiment complements surveys among clients of an Italian bank before the financial crisis in 2007 and when the crisis was vivid in mid-2009. Risk aversion was measured qualitatively by asking clients about their willingness to take risks and quantitatively by asking them to specify the specific amounts that would persuade them to forego a 50-50 chance of winning 5,000 euros.

Both measures indicated higher risk aversion in the crisis period than in the pre-crisis period, and these measures are consistent with actual changes in the portfolios of the bank’s clients.9

Financial advisers are teachers. They encourage and teach clients to examine emotions with cognitive reflection. When stock prices are high, they remind clients that the prices can go down. And when stock prices are low, they are rewarded by their clients’ calm in the knowledge that prices will likely go up.

Authors

Consultant to Avantis Investors®

Explore More Insights

Joseph Engelberg and Christopher A. Parsons, “Worrying About the Stock Market: Evidence from Hospital Admissions,” Journal of Finance 71 (2016): 1227-1250.

Anita Ratcliffe and Karl Taylor, “Who Cares About Stock Market Booms and Busts? Evidence from Data on Mental Health.” IZA Discussion Paper No. 6956 (October 2012).

William N. Goetzmann, Dasol Kim, and Robert J. Shiller, “Crash Beliefs from Investor Surveys,” (March 19, 2016). Available at SSRN.

Alain Cohn, Jan Engelmann, Ernst Fehr, and Michel André Maréchal, “Evidence for Countercyclical Risk Aversion: An Experiment with Financial Professionals.” American Economic Review 105, no. 2 (2015): 860-885.

Lieven Baele, Geert Bekaert, Koen Inghelbrecht, and Min Wei. “Flights to Safety,” NBER Working Paper No. w19095 (May 2013).

Joe Light, “Retirement Investors Flock Back to Stocks,” The Wall Street Journal, May 1, 2014.

Arvid O. I. Hoffmann and Thomas Post, “What Makes Investors Optimistic, What Makes Them Afraid?” Netspar Discussion Paper No. 11/2012-044 (March 2012).

Chan Jean Lee and Eduardo B. Andrade, “Fear, Social Projection, and Financial Decision Making,” Journal of Marketing Research 48, no. SPL (November 2011): S121-S129.

Luigi Guiso, Paola Sapienza, and Luigi Zingales, “Time Varying Risk Aversion,” NBER Working Paper No. 19284 (August 2013).

Glossary

S&P 500® Index: A market-capitalization-weighted index of the 500 largest U.S. publicly traded companies. The index is widely regarded as the best gauge of large-cap U.S. equities.

This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

The contents of this Avantis Investors presentation are protected by applicable copyright and trademark laws. No permission is granted to copy, redistribute, modify, post or frame any text, graphics, images, trademarks, designs or logos.

Contact Avantis Investors

inquiries@avantisinvestors.com

This website is intended for Institutional and Professional Investors, not Retail Investors.