The Illusion of Wealth

Key Takeaways

Choosing lump sums over monthly income can distort perceptions of wealth and adequacy, influencing retirement savings decisions.

At lower levels of wealth, lump sums appear more appealing, while monthly payouts become more attractive as wealth increases.

Understanding payment formats affects financial choices, such as when to claim Social Security benefits, which can impact long-term retirement income.

Imagine you’ve been granted a choice from a magic (retirement) genie. He asks if you’d rather have $100K at the start of your retirement or $500 per month for the duration of your retirement.

Which would you choose? Or, what if the choice was $200K versus $1K per month? Which option seems more adequate—the lump sum or monthly amount?

In reality, an annuity purchased for $100K would result in a guaranteed lifetime income of about $500 per month while one bought for $200K would yield roughly $1K per month. These lump sums and annuitized streams, in other words, are economically equivalent. But are they psychologically equivalent?

Perceptions of Wealth—Lump Sums Versus Monthly Income

Some years back, my colleagues Dan Goldstein, Shlomo Benzartzi and I investigated this question in several studies involving thousands of middle-aged adults (approximately ages 40-60) with varying incomes, educational levels and ethnicities. In one study, for example, we asked a group of people if they thought $100K, $200K, $1M or $2M would be adequate to fund their retirement years. To keep things well controlled, we told them to imagine that each sum represented the total amount of money they would have to spend in retirement. We asked a separate group how adequate these same amounts would be as monthly income of $500, $1K, $2K and $4K.

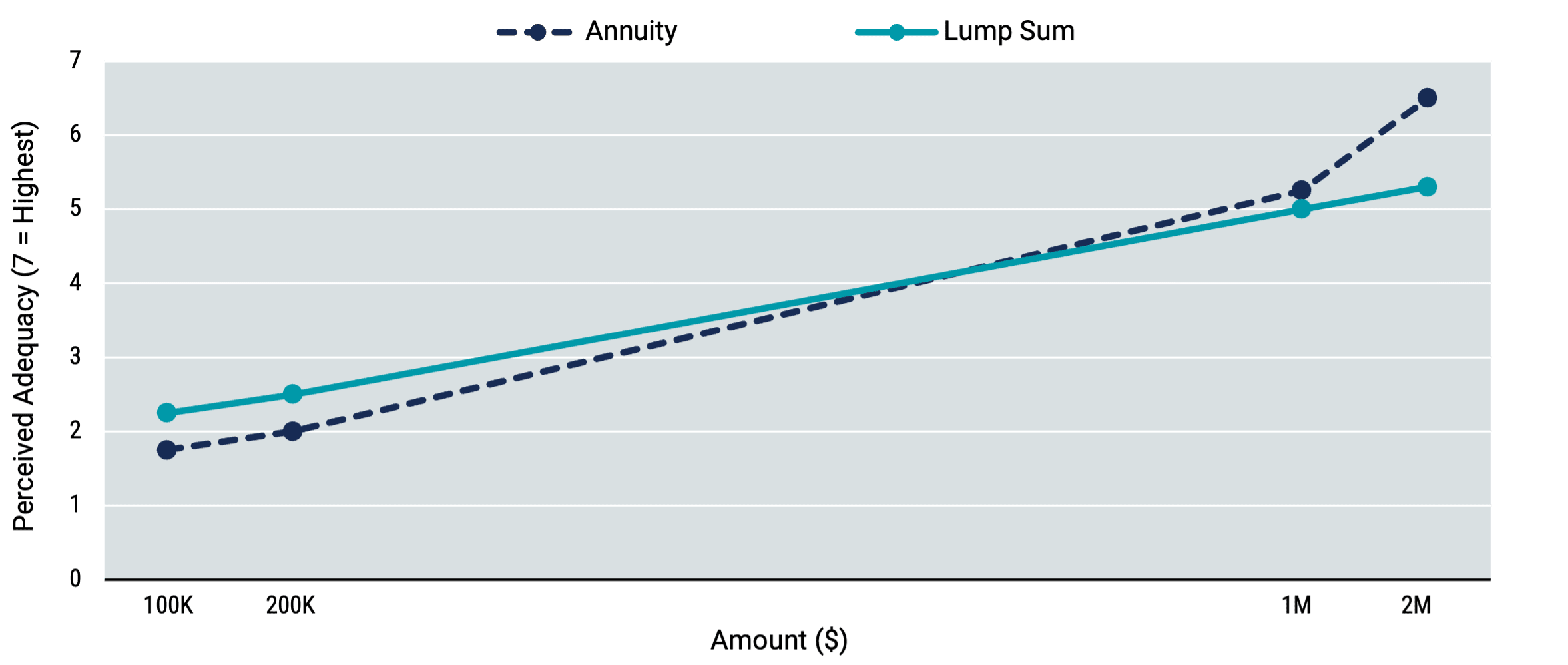

Not surprisingly, as shown in Figure 1, a lump sum of $100K didn’t rate very high on perceived adequacy. Our research participants gave it roughly a 2.25 on a 1-7 scale (where 7 represented “totally adequate”).

But people didn’t think about $500/month in the same way. That amount garnered roughly a 1.75 on our seven-point scale. The same was true for the $200K lump sum (which averaged a 2.5 rating) and the $1K/month annuity (which rated a 2).

Figure 1 | Perceived Adequacy (Between Subjects) of Amounts of Money in 401(k) Plan

Source: Goldstein, Hershfield and Benartzi, 2016.

Annuity Income May Boost Saving Intentions

Although lump sums and their equivalent monthly amounts are financially the same, they are not psychologically equivalent. At times, lump sums may seem like they are worth more than their resulting annuitized streams. This matters for more than just simple perceptions of adequacy.

When offered a $200K lump sum versus an equivalent $1K monthly annuity, research participants in another of our studies were more motivated to increase their retirement savings (in a hypothetical context) when seeing the annuity compared to the lump sum. In other words, the $1K monthly annuity seemed less adequate and therefore boosted savings intentions.

But the story isn’t quite so simple. Yes, lump sums may sometimes seem more adequate than their annuitized streams. But look what happens when we asked people about the adequacy of a $2M lump sum versus an annuity of $4K per month—the annuity seemed more adequate than the lump sum.

Annuities Become More Attractive When Amounts Are Larger

What’s going on here? When people think about how much money they’ll have for the future, more money will always seem better. But the mode of distribution—a lump sum or a monthly amount—will change perceptions of that wealth. From mortgages to car payments to credit card statements, we typically have more experience dealing with monthly amounts of money and whether a given amount will cover our expenses on a monthly basis.

As a result, it appears that people are more sensitive to changes in wealth expressed in monthly terms. This sensitivity can set up an interesting situation in which people perceive monthly amounts as less attractive than lump sums at lower levels of wealth (e.g., $100K lump sum versus $500 monthly). At lower levels of wealth, people can more accurately judge just how little a given amount would get them. We call this situation the “illusion of wealth.” Yet, people see monthly sums as more attractive at higher levels of wealth (e.g., $2M lump sum versus $4K monthly income) where people can more accurately judge just how much a higher amount would buy them, or the reversal of the illusion of wealth.

These illusions can affect other financial decisions as well. Claiming Social Security benefits early, for example, results in slightly lower monthly payments over the course of retirement. When the earliest claiming age was 62, workers would forego $119 per month if they claimed benefits at 62 compared to 63. Over time, however, that same amount in lump-sum form would be equal to about $21,492. The illusion of wealth would suggest that the $21,492 lump sum seems larger and, therefore, a more painful amount to give up compared to the $119 monthly payment.

But it’s not just large decisions like retirement claiming age that are relevant. Consider the case of liabilities. Focusing on small monthly payments spread out over time can have detrimental effects on overall financial well-being if we simultaneously ignore the effects of compounding interest.

Numbers in Isolation Probably Don’t Provide Enough Information

Taken together, we might be better served to question the format we use when making various important financial decisions. Each number—whether it is a monthly amount or a lump sum—is probably not sufficient to use as the basis for a well-informed decision. Rather, when making saving, spending and investment decisions, we are likely better served by understanding both the sum and its broken-out parts.

In fact, it’s this very insight that was at the heart of one of the regulations from the Setting Every Community Up for Retirement Enhancement (SECURE) 2.0 Act: 401(k) and other workplace retirement plans have been required to show employees what their savings would translate to in terms of monthly income in retirement. And if that calculation sounds difficult (it is!), there’s even a handy calculator you can use.

Authors

Consultant to Avantis Investors®

Explore More Insights

The opinions expressed are not necessarily those of Avantis Investors®. This information is for educational purposes only and is not intended as investment advice.

The contents of this Avantis Investors presentation are protected by applicable copyright and trademark laws. No permission is granted to copy, redistribute, modify, post or frame any text, graphics, images, trademarks, designs or logos.

Contact Avantis Investors

inquiries@avantisinvestors.com

This website is intended for Institutional and Professional Investors, not Retail Investors.